What are the stories behind The Merchants Trust’s portfolio?

Stock Stories brings you closer to the heart of our investment strategy. In these short videos, our investment team discuss interesting stocks and how they contribute to our objective of delivering a high and rising income together with capital growth for our shareholders by investing in a diversified portfolio of well-established UK-listed companies.

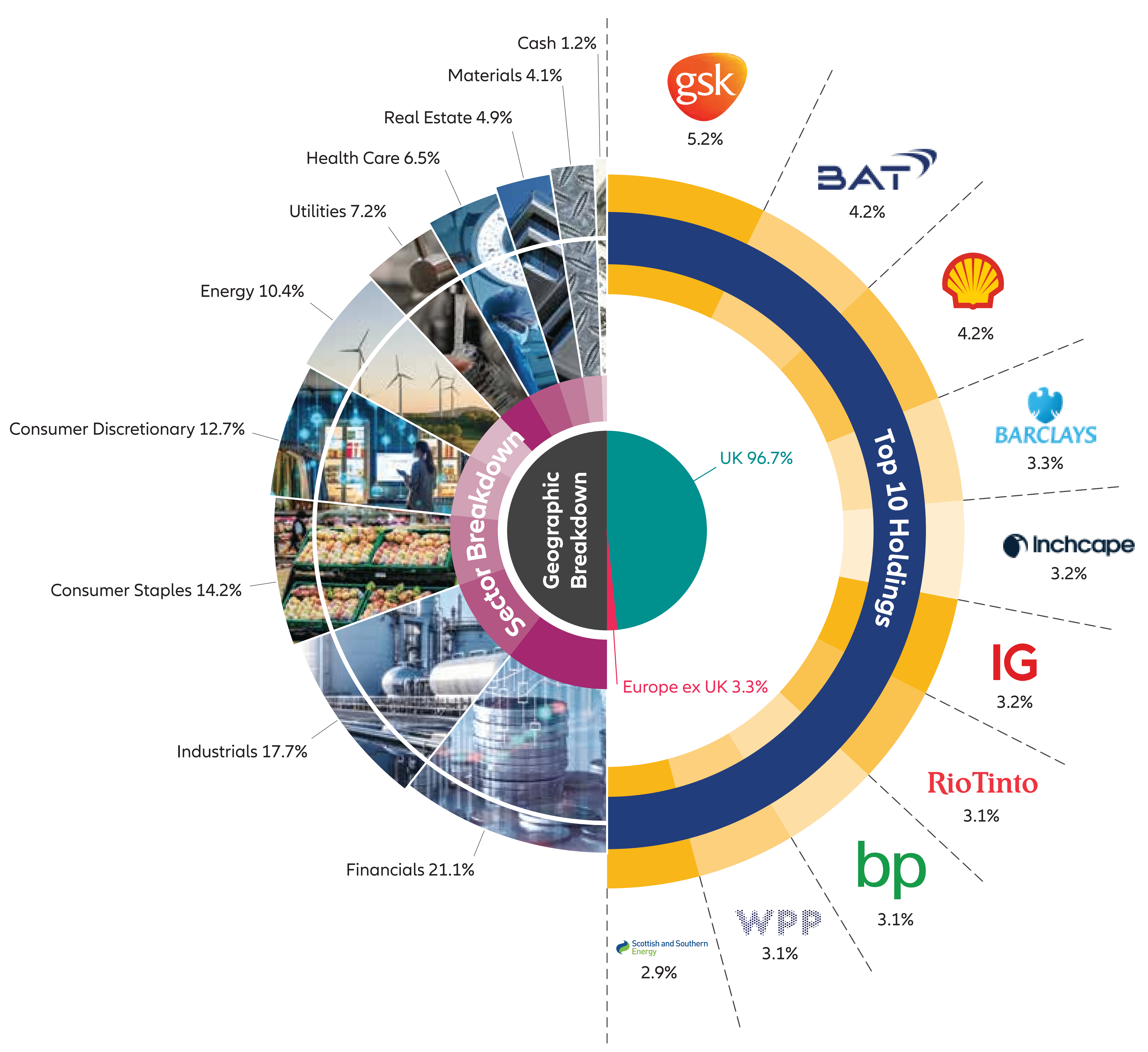

A Typical Breakdown of The Merchants Trusts’ Top Holdings:

Source:

Top 10 Holdings: Data as of 31.05.2024.

Sector Breakdown: Data as of 31.05.2024.

Geographic Breakdown: Data as of 31.05.2024. Excludes Cash

Securities mentioned in this document are for illustrative purposes only and do not constitute a recommendation or solicitation to buy or sell any particular security.

These securities will not necessarily be comprised in the portfolio by the time this document is disclosed or at any other subsequent date.

This is for guidance only and not indicative of future allocation.